Pay Monthly Clearance Products

Looking for a bargain without compromising on quality? Our clearance collection is packed with great-value pre-loved, second-hand and ex-display products at reduced prices.

A total of 26 products in this collection

Pay Monthly with Zero Deposit.

Grab a deal on clearance and pre-loved products with zero deposit and flexible pay monthly options. Stock changes regularly, so you can pick up reduced-price furniture, electronics and home essentials while spreading the cost in a way that suits you.

About usWhy Choose a Pre-Loved or Clearance Product?

Pre-loved and clearance products are a great way to save money while still getting something you’ll use every day. Whether it’s a second-hand phone, an ex-display sofa, or a clearance TV, you can often pick up high-quality items for a much lower price than buying brand new.

1. Affordable Payments

With our flexible financing options, you can spread the cost of your pre-loved and second-hand products over several months. Enjoy quality items at a fraction of the cost without breaking the bank.

2. Wide Selection

Explore a vast range including:

-

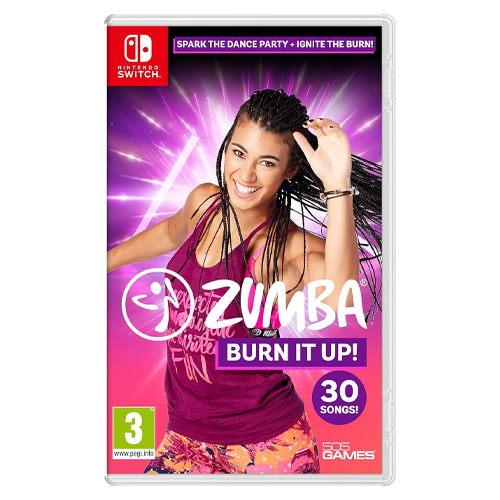

- Electronics: Affordable gadgets, including smartphones, laptops, and TVs.

- Home Essentials: Quality kitchen appliances, home decor, and more.

- Outdoor Equipment: From garden tools to patio furniture, find great deals on pre-loved outdoor gear.

3. No Hidden Fees

Our transparent payment plans ensure there are no hidden costs. What you see is what you get, with no surprises.

FAQs

Yes. Each clearance or pre-loved item is checked before it’s added to this page to make sure it’s working as it should and suitable for resale. Because stock can include second-hand and ex-display products, condition may vary, so it’s always worth enquiring if you want to confirm the exact details before ordering.

Clearance and pre-loved products are often limited stock and reduced in price, so returns can be handled differently compared to brand-new items. The best option is to enquire before you commit so you can double check condition, availability and any return terms that apply to the product you’re interested in.

This is a type of borrowing called ‘hire purchase’ – you don’t own the goods until you have paid in full. If you fall behind with payments, or have financial difficulties such that you cannot pay, you may be able to return the goods to your lender, Family Finance. They also have the right to repossess the goods if you stop paying.

‘Rent-to-own’ is a specific category of ‘hire purchase’ which has to ensure that the interest rate on the agreement is not too high. The total amount you pay for the goods never exceeds double the cash price (including delivery etc charges). Additionally, the price of the goods is checked against at least 3 other retailers to ensure it is competitive, in a process called benchmarking.

There are different payment options available including payment through a standing order, Continuous Payment Authority (CPA), cash, debit card and bank transfer.

Your first repayment is normally due within 1 month of you receiving the goods.

We work with our lending partner, Family Finance, who offer ‘rent-to-own’ hire purchase agreements over a period of 1-3 years for you to purchase Family Vision goods. The exact terms will depend upon your personal circumstances and on the affordability assessment undertaken by Family Finance. This is to ensure the repayments are affordable for you.

Yes, we will still consider all applications. Your credit file is just one of the factors we will take into consideration when making a decision to give you credit so don’t let that put you off. Other factors will be your income and outgoings and if you have any previous record with us. Our goal is to try and help those most in need get back on track and provide a line of credit to customers that may not be able to use mainstream lenders due to previous poor decisions. Please see the “what is your interest rate” tab below where all interest charges are explained or visit our payment calculator.

You must have a regular income and the ability to repay the loan on time. Our lending partner, Family Finance, will consider current and previous credit history as part of the affordability assessment. We obviously cannot guarantee that everyone who applies will be successful.

We’re here if you need support or advice

Need clarity before you enquire? Find answers in the FAQs, or get in touch for support.

Contact Us